Editor’s note: From July 31st to August 2nd, the “2023 China Heat Pump Industry Annual Conference” hosted by the China Energy Conservation Association and hosted by the China Energy Conservation Association Heat Pump Committee was successfully held in Nanjing. During the conference, a “Forum on Heat Pump Exports and International Market Development” was held, and Dr. Martin Sabel, Secretary General of the German Heat Pump Association, delivered a speech on the theme of “The Latest Changes in the German Heat Pump Market and Policy Development”. The following are the main contents of the report:

Hello everyone, it is a great honor to have the opportunity to participate in this conference. The content I am sharing today is divided into two parts: the current situation of energy transformation in Germany and the current situation and future prediction of the German heat pump market.

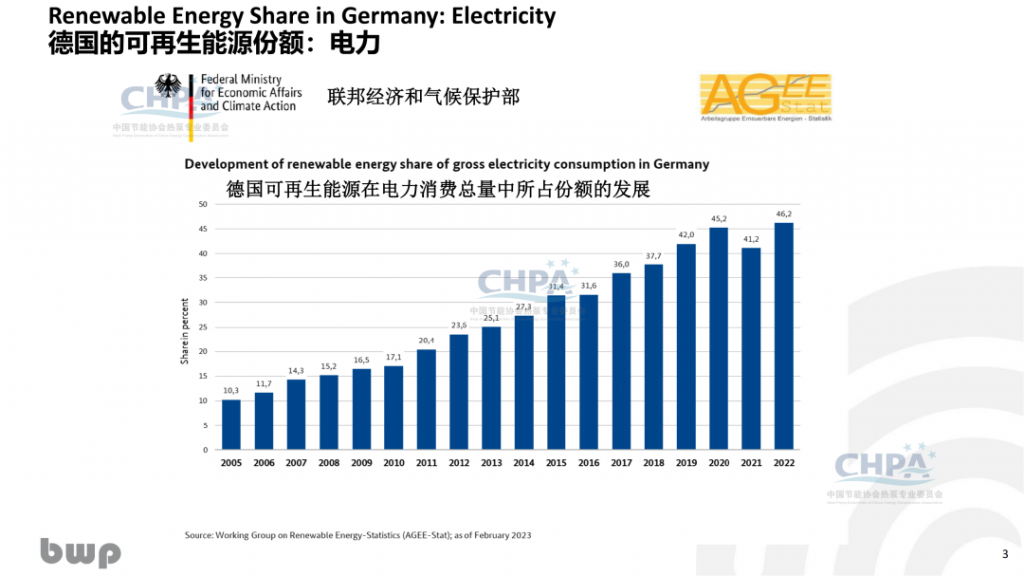

A heat pump is a heating device driven by electricity, and currently renewable electricity accounts for about 50% of the entire German power system. The goal is for renewable electricity to account for 80% of the entire German power system by 2030.

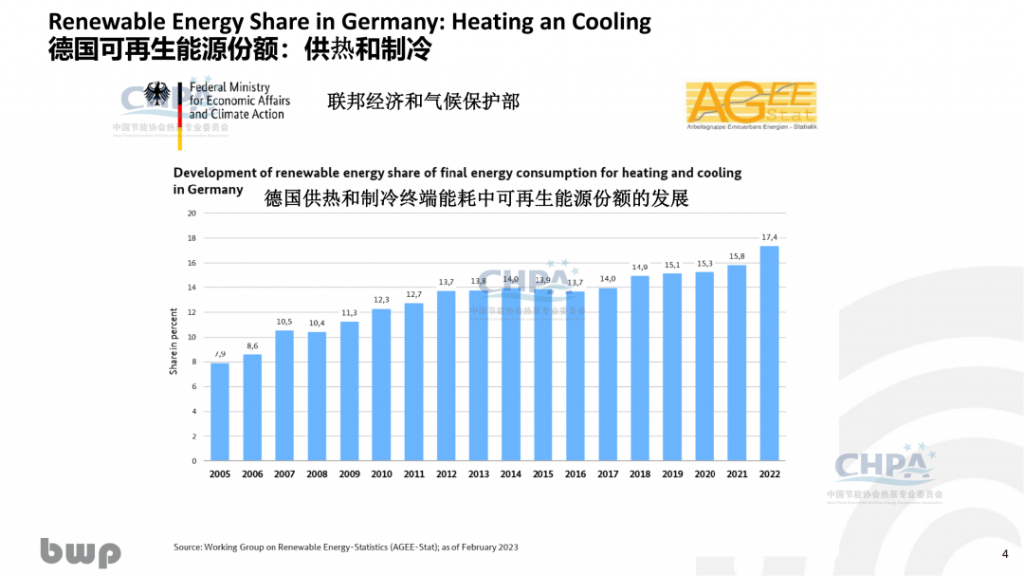

The proportion of renewable energy in the heating and cooling sector in Germany is only 17%, and the current situation in Europe is similar to Germany. Germany has set a goal of achieving a 50% share of renewable energy in the heating and cooling sector by 2030.

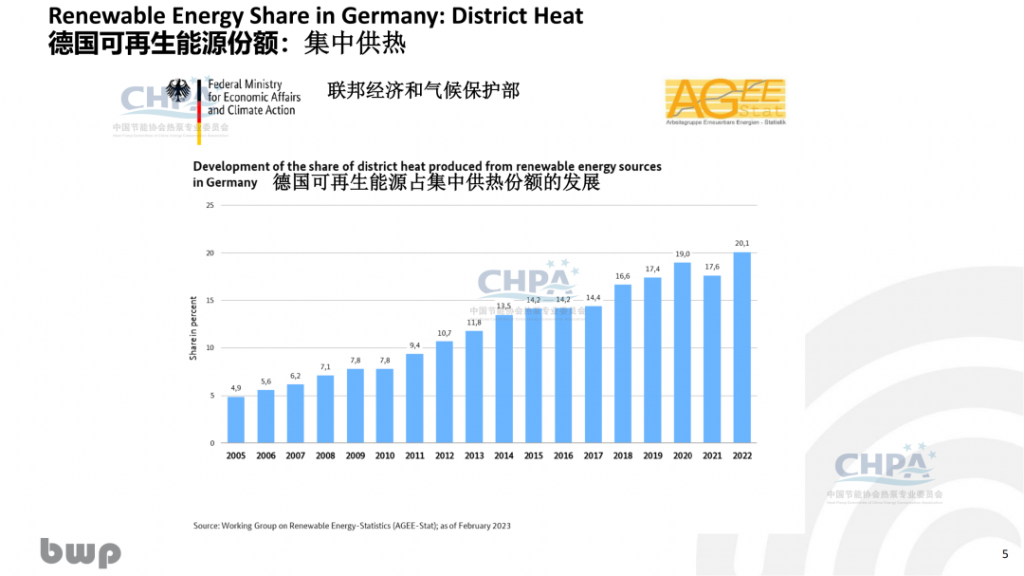

The proportion of renewable energy in central heating in Germany is about 20%.

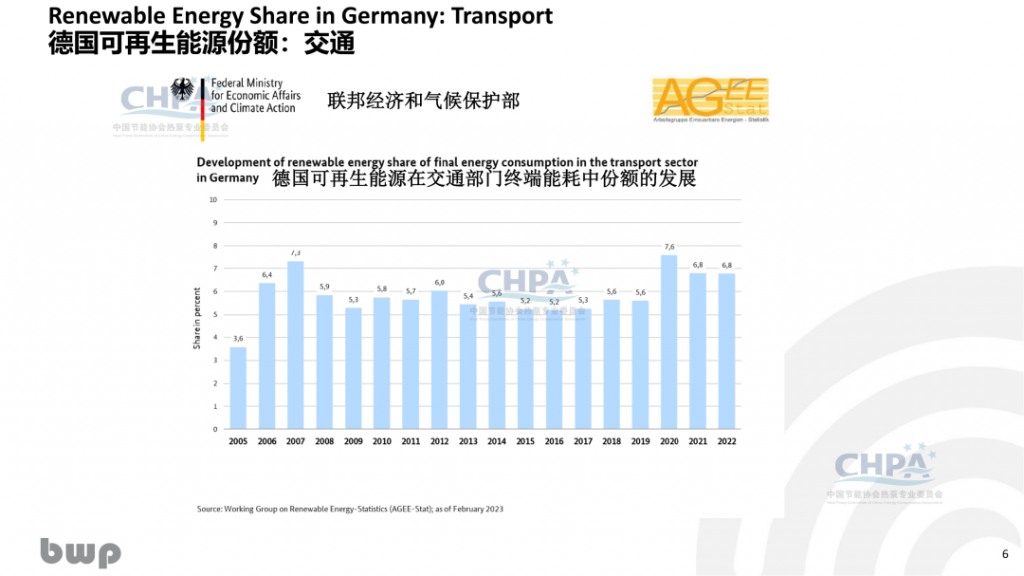

The proportion of renewable energy in the transportation sector is about 7%.

The following figure shows the development trend of heat pumps in Germany. Currently, the installed capacity has reached 16GW, and the goal is to achieve a sales volume of 6 million heat pumps by 2030.

Electricity will become the core energy carrier. The figure below shows the net electricity consumption in Germany’s industrial, transportation, and construction sectors. I will focus on the net electricity consumption in the construction sector. At present, the construction industry mainly relies on fossil fuels for heating. It is expected that by 2045, heat pumps will account for a large proportion in the field of building heating. From the figure, it can be seen that electric heaters and others have a slightly higher proportion in the heating industry, but the proportion is not very high. Central heating has many scenarios where electricity can be applied, and electricity will become the core energy carrier in the future, which requires us to use more renewable energy to generate electricity. The following figure shows two situations where heat pumps can be applied in the field of central heating. The top is the current status of energy utilization in central heating. Fossil fuel power plants provide heat to households through the heating network. We can replace fossil fuel power plants with large heat pumps, and high-temperature heat pumps can generate temperature and directly provide heat to residential households. Alternatively, heating can be achieved through a low-temperature heating network, which does not require particularly high temperatures and is mainly achieved by installing heat pumps in each household. The heat pump efficiency is very high, reaching 350%. The following figure shows the annual sales of heat pumps in Germany, which achieved a 53% increase in sales last year. The German market is mainly dominated by air/water heat pumps. In the first half of 2023, the sales of heat pumps in Germany were already in line with the sales of the entire year last year, and it is expected that the German heat pump market will have a very bright growth this year. The following figure shows the current situation of the heating market in Germany. In 2022, Germany sold approximately 1 million heating equipment, with gas facilities still accounting for the largest proportion. From the trends in recent years, it can be seen that gas equipment has replaced a large number of fuel equipment. What we need to do now is gradually replace gas and other fossil fuel equipment with heat pumps. We will continue to promote this work.

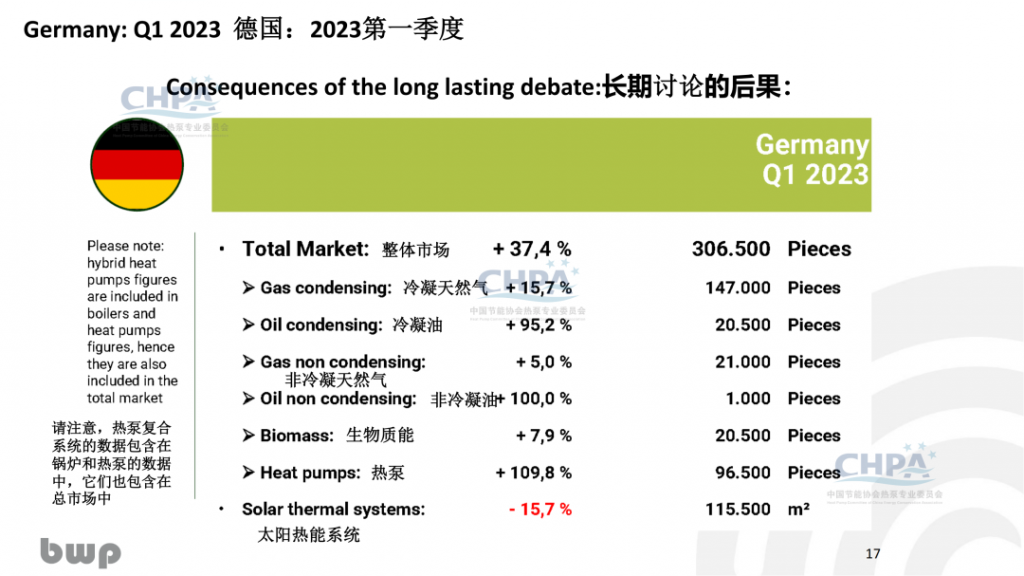

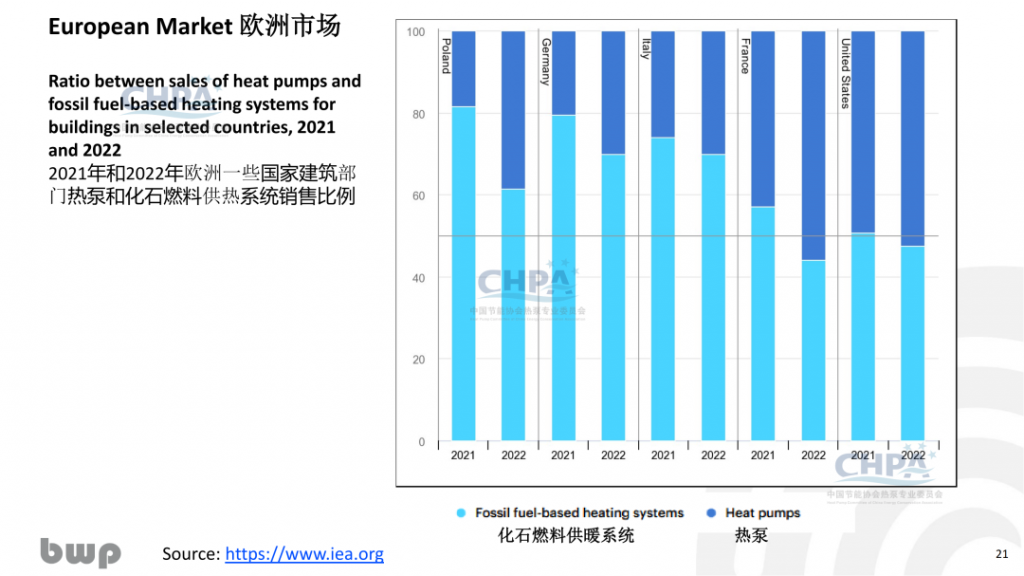

The chart below shows a market forecast conducted by the German Heat Pump Association. In 2022, the sales volume of heat pumps in Germany will be approximately 230000 units. Our goal for this year is to reach 300000 units, and the sales volume is planned to reach 500000 units by 2024. According to the forecast, the sales volume of heat pumps in Germany will reach 1 million units by 2027. According to other institutions’ predictions, 6 million heat pumps are needed for decarbonization in the heating industry in Germany. We refer to this research result, And based on the current sales volume, this prediction has been made. Whether our prediction can be achieved requires prerequisite conditions. The first and most important thing is energy prices. Currently, electricity prices in Europe are higher than gas costs. We need to reduce value-added tax, electricity tax, and other taxes on electricity to make it more economical. In addition, the mandatory bill currently being discussed in Germany, the Building Energy Law, is still a revision and is expected to be officially implemented next year. After the implementation of the Building Energy Law in Germany, whether it is new buildings or old buildings replacing fuel equipment, heating must be supplied by renewable energy at least 65%. After the implementation of the law, heat pumps will play a crucial role in the heating system of German buildings. In addition, promoting the development of heat pumps also requires some industrial policies and funding plans. Germany currently has corresponding funding plans, but their updates are still under discussion. In order to enable homeowners to comply with the provisions and obligations of the Building Energy Law, Germany will update the existing funding plan. However, as this discussion is still ongoing and the funding plan has not been finalized, some homeowners are currently confused about whether future funding will change, and most are taking a wait-and-see attitude. As a result, the current sales of heat pumps have slightly declined. The following figure shows the data of the German heating market in the first quarter of 2023. The growth rate of heat pumps has exceeded 100%, but at the same time, there has been a certain increase in gas and fuel equipment. We hope that the growth of fuel and gas equipment can stop. The figure below shows the situation of the European heat pump market. It can be seen that in 2022, the average number of heat pumps purchased by every 1000 households ranked second in Germany, so there is still great potential in the German heat pump market. The chart below shows the European heat pump market in the IEA report. Compared to other countries, Germany has a very high proportion of fossil fuels in heating systems. Therefore, there is still a large market space for using heat pumps to replace fossil fuel systems. That’s all for our report, thank you all!